December 18, 2014

BEIRUT, Lebanon — After three months of lengthy discussions,

at the beginning of December, the Kurdistan Regional Government (K.R.G.) and

Iraq's central government finalized a deal with reference to the distribution

of oil revenues in Iraq. An important breakthrough had already happened in

November when the two sides agreed on a couple of confidence-building gestures:

the K.R.G. provided to Iraq's State Organization for Marketing of Oil (SOMO), 150,000

barrels per day (bbl/d) of Kurdish oil at the city port of Ceyhan (Turkey) during

the final two weeks of November, and the central government made a onetime

payment of the value of $500 million to the K.R.G.

The final agreement, which will be implemented from January

2015, specifies that Baghdad will pay Erbil 17 percent of Iraq's national

budget as defined by the Iraqi Constitution, while Erbil will provide the

central government 250,000 bbl/d of Kurdish oil at Ceyhan for export. The money

received from the sales of the Kurdish oil will be deposited in an escrow

account in New York — until now the K.R.G. has deposited the money received

from its oil sales at Halkbank, the Turkish state bank. In addition, the K.R.G.

will also export via the newly built Kurdish pipeline 300,000 bbl/d of oil

extracted from the oil fields of the area around Kirkuk (Bai Hassan, Dubis and

Havana fields). These oil fields are under federal jurisdiction, but they

are currently under Kurdish control. In fact, last June, the Peshmerga forces

occupied Kirkuk in order to avoid that it could fall in the hands of the

Islamic State, the terrorist organization that now controls central and western

Iraq.

In total the K.R.G. will supply 550,000 bbl/d, which should

provide Baghdad with approximately a billion dollars per day. Technically,

shipping to Turkey via the same pipeline Kurdish crude oil (a blended medium

crude oil quality with gravity of 30 to 32 API degrees) and Kirkuk crude oil

(an average gravity of 36 API degrees) may be done only through batching in

order not to mix the two different qualities of crude oil. Apart from the

necessity of carrying out the batching of oil, another problem would be the infrastructural

gap of the present Kurdish oil pipeline, which would not be able to accommodate

so big a quantity of crude oil (the oil extracted from the K.R.G. and the

Kirkuk oil) unless additional pumping stations are added. But, in this regard,

in a conference in London, Minister of Natural Resources Ashti Hawrami of the

K.R.G. recently affirmed that the pipeline to Turkey would carry 500,000 bbl/d

by the end of the first quarter of next year and that during 2015 it could

carry 800,000 bbl/d including the 550,000 bbl/d to be market by SOMO.

|

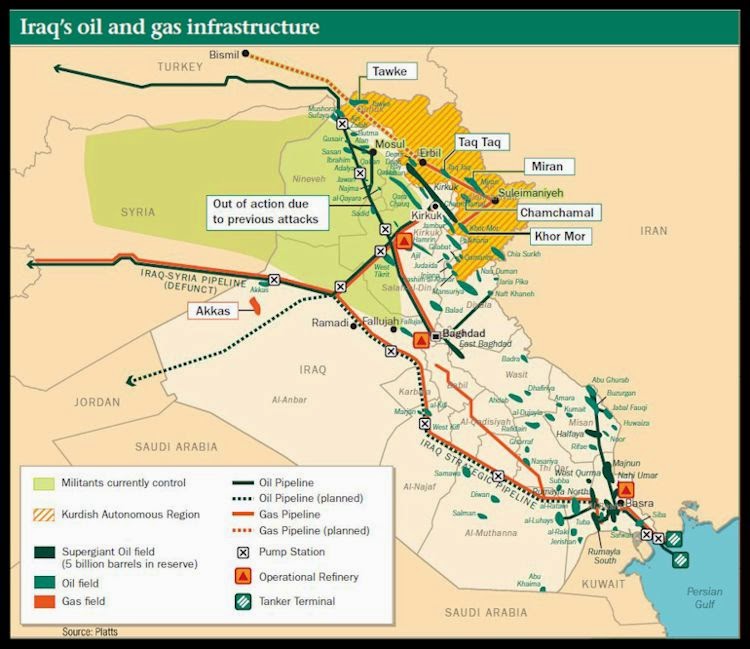

Iraqi Kurds Pipe Oil to Turkey — Map by

Lindsey Burrows

The American Interest (Dec. 2013) |

From Ceyhan, all of the barrels covered by the new agreement

will be exported by SOMO, although the Kurds initially demanded to market the

K.R.G. oil through the Kurdistan Oil Marketing Organization (KOMO). This

agreement will last for one year and could help Iraq draw Budget Law 2015 — in

this regard it is important to underline that until now the central government

has never approved Budget Law 2014 because of strong contrasts with Iraqi

Kurdistan.

As a corollary to the deal, until the end of 2014, the

K.R.G. will continue to provide SOMO with 150,000 bbl/d of Kurdish oil at

Ceyhan, and Baghdad will grant the K.R.G. another $500 million. The government

will also supply ground troops to support the Peshmerga forces in their fight

against the Islamic State in the Iraqi northern theater, and it will transfer

$100 million on a monthly basis for the salaries of the Peshmerga forces.

As a consequence of the deal, the companies operating in the

K.R.G. will receive more money. In Iraqi Kurdistan, the companies extract oil

and then the government sells it. The companies were owned almost $2.87 billion

up to last November (both in cash and bartered goods); in general until now they

have received only a small fraction of the due amount. Without at least

increased payments from Erbil, it is difficult for the foreign companies to

boost their operations in the K.R.G. For instance, in November, Gulf Keystone

Petroleum, a company registered in Bermuda, still was owned $250 million for

its activity.

It is difficult to evaluate this deal, which, as above

highlighted, will have duration of only a year and has yet to be approved by the

Iraqi Parliament; it is required a simple majority of the 328-seat Iraqi

Council of Representatives (العراقي مجلس النواب). But, if we analyze this agreement through a realistic

approach, it indeed appears as probably the best solution for the concerned

parties under the dire economic, political, legal and social circumstances

present in today's Iraq. In other words, it is a temporary agreement that does

not solve the friction points between Erbil and Baghdad but that, at least,

permits Iraqi Kurdistan and Iraq proper to improve their coffers and thanks to

this to wage with better means a war against their common present and clear

danger, which is the Islamic State. In fact, approximately one-third of Iraq —

in specific, central and western Iraq — is still under the control of this

terrorist organization, which in the last months has advanced south toward

Baghdad. Only the intervention of foreign powers (the coalition around the

U.S., and Iran) has been capable of partially limiting the northern and

southern advance of the Islamic State, which nevertheless has geographical

depth because it controls a vast area straddling Iraq and Syria. All the real

friction points will probably emerge one more time by the end of the fight against

the Islamic State, if not before — the

chickens have come home to roost.

WILL THE K.R.G. BE

INDEPENDENT FROM IRAQ PROPER?

The real goal that Iraqi Kurdistan wants to achieve is

independence from Iraq proper. In 2014, Kurdish politicians have plainly

expressed that independence is the real goal to achieve. Especially after the

occupation of the Kirkuk oil field and the Islamic State advance toward

Baghdad, the sentiment in Erbil was that the long-awaited independence was not

so far. Then, the harsh reality showed that:

- The Peshmerga forces were not capable by themselves to fight and win a complete victory against the Islamic State. Many times in the past months the Peshmerga forces have been outgunned by the Islamic State fighters. Only the backing of the U.S.-led coalition airpower has permitted to regain control of villages previously lost to the Islamic State offensive. And only in October, Turkey's Special Forces started training the Kurdish fighters with reference to the use of heavy weapons.

- Both Turkey and Iran, although on a different basis, were against the independence of the K.R.G. from Iraq. In fact, Iraqi Kurdistan is highly dependent on both countries for trade, investment and transport. It is quite unclear whether the Kurds have the strength to stand alone in a very turbulent region without the support of their neighboring countries. As Deputy Prime Minister Qubad Talabani of the K.R.G. pointed out to Al-Monitor, a media site covering the Middle East, "We have grounds to become independent, but we have to also realize we are not neighbors to Luxembourg or Switzerland.”

- The K.R.G. was on the verge of bankruptcy. In February, Baghdad stopped the payment of 17 percent of the state budget (a monthly payment worth $970 million) after the K.R.G. at the beginning of the year started independent pipeline exports to Ceyhan — although the first tanker for export in Turkey was loaded only in May. Kurdish public officials have not received their salaries for several months. Kurdish sources affirmed that before the interruption of the payments they had always received less than 17 percent of the budget (they said around 12 percent). And in the past months, in order to cover the payments of its civil servants and to fund public projects, the K.R.G. has been obliged to borrow around $4 billion from foreign companies that operate in Iraqi Kurdistan. Plus, the K.R.G. is presently sustaining a financial strain linked to the influx of refugees from Iraq.

- The slump in oil prices has been an additional problem. Oil prices were as high as $107 a barrel in late June, and today they are around $59 per barrel. Some sources affirm that as result of the unclear legality of the Kurdish exports, Erbil has always been obliged to sell its crude oil at discounted prices. It goes by itself that the current slump is an additional hurdle for Iraqi Kurdistan. Oil price analysts point out that the price of oil will not recover consistently quite soon, and that it is possible that for the whole 2015 prices will continue to be low.

So, Kurdish independence is out of question for the time

being; in the future maybe.

BAGHDAD HAS NECESSARILY

TO INCREASE ITS OIL OUTPUT

On the Baghdad side, solving once and for all the legal

dispute related to Kurdish oil contracts with foreign oil companies and Kurdish

oil exports independent of any authorization by Baghdad is not achievable under

the current circumstances. In Iraq, the time of a clear definition of the

hydrocarbons sector legal environment has to be postponed. It is pointless

trying to define legal issues when: one-third of the country is occupied by the

Islamic State, Iraqi Kurdistan wants to be independent, foreign countries are

conducting military operations in Iraq, and a new government (Prime Minister

Haider al-Abadi) is trying, amid many difficulties but with good results, to

expand its consensus basis especially with the disenfranchised Sunni

population. Discussing sector-specific laws or the interpretation of some

articles of the Iraqi Constitution (namely Article 112) when the overall structure

of the federal republic of Iraq is questioned is equivalent to put the cart in

front of the horse. For the sake of knowledge, in the oil sector, the quarrel

between the K.R.G. and Iraq proper started ten years ago, when Erbil awarded

the first oil contract without any prior authorization by Baghdad.

Also for Baghdad, the most important and pressing problem is

now to increase its revenues. With a projected budget deficit of about $40

billion, Iraq needs to boost its production notwithstanding the current slump

in oil prices and the discontent within OPEC for an increase of Iraq's oil

production (now at 3.3 million bbl/d, primarily from the southern oil fields

with an overall export of 2.4 million bbl/d to 2.6 million bbl/d), which could

additionally sink the price of oil. Iraq has not been included in the OPEC

system of quotas for almost a quarter of a century, but, according to the

International Energy Agency (I.E.A.), Iraq will produce 6.1 million bbl/d by

2020 and 8.3 million bbl/d by 2035; Iraq will account for 45 percent of the

total growth in global oil output by 2035. The only at the moment available and

quick ways for Iraq to boost its production are:

- to return in charge of the revenues from the Kurdish oil fields.

- to return in charge of the production from the oil fields around Kirkuk.

In fact, in the last ten years the Kurds have consistently

developed the K.R.G. oil industry, and now ten oil fields have been declared

commercial (significant production comes from four fields). The Kirkuk field

was brought in production in 1934, and, notwithstanding the troubled history of

the last 14 years, with proper management it should still be able to produce

400,000 bbl/d to 500,000 bbl/d. Then, upon completion of the current renovation

projects by British Petroleum (BP) and the linking of the Kirkuk pipelines to

the Kurdistan-Turkey Pipeline, the capacity of the Kirkuk oil field could reach

700,000 bbl/d and a million bbl/d in a year. For more information see: BACCI, A., BP Continues Investing in Iraq. With T.S.C.s the Devil Is Always in the Detail(s), October 2013.

|

Kirkuk District,

Oil Gusher Spouting (circa 1932)

G. Eric

and Edith Matson - G. Eric and Edith Matson, Matson Photographic Collection,

Library of Congress

|

Of course, Iraq would like to increase its oil production

coming from the southern fields as well. This year the development there has

proceeded quite well, but some important infrastructural gaps have already

emerged and will not solved soon (not before 2017-18). "The problem in the

south is that joint infrastructure, whether terminal storage and pumping

capacity, water availability or gas handling, remains well behind schedule.

Water injection is one of the most urgent issues" says Bassam Fattouh, the

director of the Oxford Institute for Energy Studies.

THE NEW DEAL POSTPONES

ANSWERS TO DIFFICULT QUESTIONS

In the last days, both the K.R.G. and Iraq have tried to

avoid answering directly and conjointly to questions related to the two most

visible friction points:

- What to do with the K.R.G. oil production in excess of the quantity agreed upon by Erbil and Baghdad, and how to deal with Kurdish oil that has already been exported since May.

- The control of the Kirkuk oil field.

It would be interesting to understand what will happen to

the quantity of Kurdish oil in excess of 250,000 bbl/d exported by the K.R.G.

and to the previous Kurdish oil exports legally challenged by Baghdad. Last

month, Iraqi Kurdistan affirmed to have exported through Turkey since May

approximately 34.5 million barrels, which Baghdad considers illegally exported.

According to Reuters, it seems that after the K.R.G. initial difficulties finding

buyers for its exported oil, Trafigura, one of the world's most important

trading firms, successfully handled some of the Kurdish cargoes to several

destinations.

The point related to how handling the oil quantity in excess

of 250,000 bbl/d will be relevant soon in the coming year because the K.R.G. is

increasing its exporting capacity to 500,000 bbl/d by the end of the first

quarter of 2015 and then to 800,000 bbl/d during 2015. Presently, Iraqi

Kurdistan is already exporting around 300,000 bbl/d, while current production

is 400,000 bbl/d, of which 100,000 bbl/d are used for the manufacture of the

refined products consumed within the K.R.G. In practice, already in 2015, there

will be a quantity of Kurdish oil in a sort of legal vacuum. In this regard,

immediately after the agreement, Deputy Prime Minister Qubad Talabani of the

K.R.G. said that the new deal had acknowledged the legality of the K.R.G.

exports. But then, after just three days, the Oil Ministry of Iraq issued a

counterstatement where it affirmed that any oil dealings outside of the numbers

and frameworks included in the deal would be considered illegal. The statement

continued denying the existence of any "verbal or written agreements"

that could have permitted the K.R.G. to export oil outside of the framework of

the agreement. Later, Mr. Hawrami said that the K.R.G. would continue to market

a portion of its crude oil while negotiating the terms with Baghdad.

|

| Minister of Natural Resources

Ashti Hawrami of the K.R.G. Photo by Rojava News |

The second important point missing in the discussions

between the K.R.G. and Iraq proper is the future of the Kirkuk oil field. An

initial consideration: For Baghdad it will always be difficult to administer

the three governorates of Iraqi Kurdistan as if they were one of the other 16 Arab

governorates of Iraq. The K.R.G. is already a semi-autonomous region with

special powers: in practice it is a Kurdish area within an Arab country. But,

with reference to Kirkuk Governorate, which is one of the three governorates

disputed between the K.R.G. and Iraq proper, things are not so straightforward.

For more information see: BACCI, A., Iraqi Kurdistan's Occupation of Kirkuk Oil Field Will Deeply Affect the Iraqi Oil Sector, June 2014.

The value of the Kirkuk oil field is tremendously important

for both the contestants. In fact, according to the latest data, the Kirkuk oil

field is home to at least 12 billion barrels of crude oil. Iraq's North Oil

Company now claims that the reserve is much higher; it estimates the oil

reserve between 20 to 25 billion barrels. In particular, losing control of the

Kirkuk area would probably have relevant consequences with reference to the

territorial dimensions of Iraq because it is evident that if, in the future,

the Kurds maintain control of Kirkuk, then Baghdad will never be able to have a

word in relations also to the oil exported from the three original Kurdish

governorates. In other words, Kurdish control on a permanent basis of Kirkuk

means for Baghdad that two out of three of the most important oil-producing

areas in the whole Iraq would be controlled by the Kurds. Indeed, Baghdad would

remain in charge of the huge and profitable southern oil fields, but it would

have a curtailed influence in the oil business. Another Iraqi area where there

should be sizable oil and gas reserves is Anbar Governorate, which has never

been developed to date. The problem is that this governorate is under the

Islamic State occupation.

Moreover, until this summer, Kirkuk oil field used to

provide 280,000 bbl/d to the Baiji refinery for the domestic consumption of 11

Iraqi provinces. Since then, the refinery has been contested by the Islamic

State and Iraqi forces. Currently, it is under Iraqi control but deep in

Islamic State-controlled territory. Iraq is able to refine only 600,000 bbl/d

of crude oil (a small quantity for a country as big as Iraq), of which half

barrels are refined by the Baiji refinery, which is strategically located in

order to be well supplied with crude oil coming from Kirkuk. As a consequence

of the current complex situation around the Baiji refinery, Baghdad has been

already forced to import additional gasoline, diesel and L.P.G. (butane and

propane).

|

Baiji Oil Refinery

PUK Central Council |

HOW DOES THE

BAGHDAD-ERBIL DEAL AFFECT TURKEY?

After the deal, the exclusivity relation that Turkey has

cultivated with the K.R.G. for the last three years has been partially reduced.

But, it is also true that for the Kurds this tight relation with Ankara was a

springboard toward first economic independence and then political independence

from Baghdad. And Ankara has always opposed an independent Iraqi Kurdistan

because this would have created problems in the Kurdish-inhabited parts of

Turkey — 18 percent of Turkey's population is Kurd; from 1984 to 2013 the

Kurdistan's Workers Party (P.K.K.) fought an armed struggle against the Turkish

state for cultural and political rights and self-determination for the Kurds in

Turkey. Turkey's reluctance to fully support Iraqi Kurds and Syrian Kurds (in

Kobani) in their struggle against the Islamic State has to be read through the

lens of Turkish opposition to any Kurdish statehood.

The reality is that the K.R.G. and Turkey need each other.

The K.R.G. has energy resources and Turkey needs them in order to diversify its

energy suppliers — Turkey imports 90 percent of its oil. But in addition, this

relation is substantiated by pure geography as well, because Turkey is the most

evident and economically efficient route for exporting oil from the K.R.G. And

similarly, until last March when the Iraqi section of the Kirkuk-Ceyhan

Pipeline was damaged, Kirkuk oil was exported north to Turkey — and

geographically Kirkuk is more south than the K.R.G. Moreover, for Ankara, the

K.R.G. may be the only friendly entity present in the Middle Eastern neighborhood.

In fact, Turkey's so magnified "zero-problems-with-neighbors" policy

is long gone.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.