December 22, 2011

On Wednesday December 7, 2011, Qatargas, the world's largest

L.N.G. company owing a total annual capacity of 42 million tons, signed a

tripartite sales and purchase agreement (S.P.A.) with Japan's Chubu Electric

Power Company (the electric provider for the middle Chubu region of the Honshu

island) and Shizuoka Gas (one of the 211 city gas distributors in Japan with a

business area covering 10 municipalities between Tokyo and Nagoya). The Qatari

L.N.G. producer, founded in 1984, has an established relation with Japan and

its first L.N.G. shipment abroad, dating back to 1997, was delivered exactly to

Japan.

This new deal was announced during the World Petroleum

Congress in Doha, Qatar (December 4-8, 2011) and was signed by the Qatari

minister of energy and industry, Mohammed Bin Saleh Al Sada, Chubu Electric

Power Company's general manager of the fuels department, Yuji Kakimi and

Shizouka Gas' chairman and C.E.O., Seigo Iwasaki. Qatargas is already exporting

to Japan 10 million tons of L.N.G. per year. This new deal will last for five

years from 2016 to 2021 and according to the agreement every year Qatargas will

be supplying to the Japanese companies 200,000 tons of L.N.G. (the final

supplied quantity will be approximately 1,200,000 tons). The two companies will

decide how to share the L.N.G. This will be delivered ex-ship to the following

group of receiving terminals: Chita, Kawagoe, Yokkaichi, Joetsu and Sodeshi.

Also for this new S.P.A. the Qatari L.N.G. will be shipped

from Qatargas 1, which has three trains (with an annual production of 2 million

tons each) and is a joint venture with several stakeholders: state-owned Qatar

Petroleum, U.S. ExxonMobil, France's Total and Japan's trading houses Mitsui

and Marubeni.

“This agreement is remarkable in many aspects. It further

nurtures our long lasting relationship with Chubu Electric Power Company while

it welcomes Shizuoka Gas Company as the first new long-term Japanese buyer of

L.N.G., in addition to those eight buyers which formed the currently existing

consortium purchasing L.N.G. from Qatargas 1 joint venture for contracts signed

in 1992 and 1994. It is also an example of how Qatargas can grow its share of

the Japanese gas market in partnership with Chubu Electric Power Company” said

Qatargas's C.E.O., Khalid Bin Khalifa Al-Thani. He also specified that

"this agreement is further testimony of our long-term reliable commitment

to Japan and the innovative ways in which Qatargas is able support new

customers. Whether for a very large sale of L.N.G. or for a smaller volume like

under this Tripartite S.P.A., Qatargas values all of its customers and seeks to

assist them all in their aspirations to grow in the future.”

It should be underlined that during the World Petroleum

Congress in Doha two other Qatari companies accomplished important results.

Qatar's RasGas, the world's second largest L.N.G. producer after QatarGas, made

public a contract with Taiwan's C.P.C. Corporation aimed at shipping 1.5

million tons per annum of Qatari L.N.G. This deal will have a 20-year duration.

Moreover, Qatar Petroleum signed a memorandum of understanding (M.O.U.) with

U.K. Centrica aimed at investments in upstream assets, facilities for gas

storage, combined-cycle gas turbine generation assets and downstream

opportunities. Still in 2011, Centrica had previously signed a three-year

contract (valued $3.1 billion) with Qatar's state oil company, Qatar Petroleum

International (Q.P.I., it's the international investment division of Qatar

Petroleum) in order to receive 2.4 million tons per annum of L.N.G. Centrica

has been having an established commercial relation with Qatar since 2003.

In recent years, Qatar has increased its L.N.G. supplies to both

Europe and Asia. This was possible thanks to new facilities that were ready at

the end of the 2010s. Japan has been buying L.N.G. for decades and now, after

the Fukushima disaster of March 2011, L.N.G. imports will increase. In fact,

the country is implementing some stress tests for all of the Japanese nuclear

power plants while at the same time some nuclear plants are shut down for

inspection and maintenance. At the end of November 2011, only 10 out of 54 nuclear units were in operations. It's

quite evident that Japan's power companies are boosting their gas purchases.

And L.N.G. is the best currently available solution. Estimates envisage for

Japan a 2011 L.N.G. demand increase by at least 12 million tons. And Daisuke

Harada, deputy general manager of Japan Oil, Gas and Metals National

Corporation (Jogmec), has recently stated in 20 million tons the additional

L.N.G. demand for 2012 if some nuclear reactors do not restart operations.

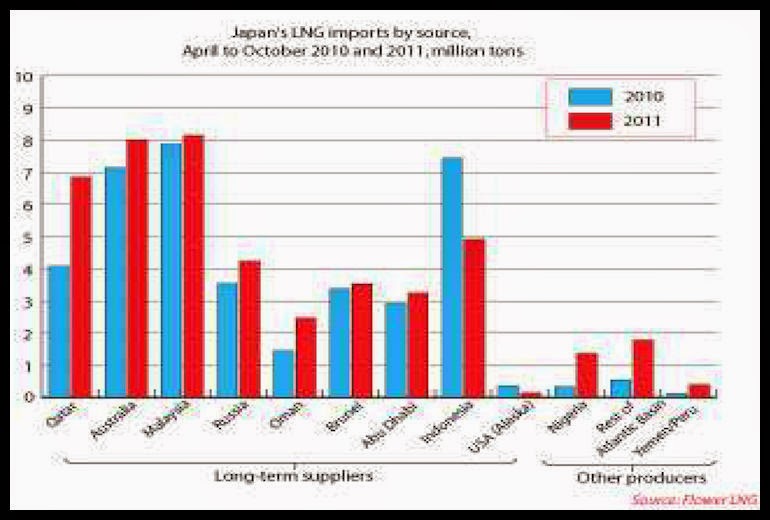

Data about L.N.G. imports for the period April-October

2011 showed a relevant increase of L.N.G.

imports in comparison to the same months in 2010. The above graph from Flower

L.N.G., a consultancy, well illustrates this trend. From April 2011 to October

2011, Qatar supplied almost 7 million tons of L.N.G., in practice 2.77

million tons more than the same period in 2010 (65.4 percent increase only from

Qatar). Similarly, the other L.N.G. producers of the Atlantic Basin, not

including Libya, increased their shipments (+1.24 million tons) as well as

did the two newest L.N.G. producers, Peru and Yemen (+0.27 million tons).

Still, with reference to the period April-October 2011, among the long-term

suppliers, apart from Qatar that increased by 65 percent its L.N.G.

exports, also Australia (+0.87 million tons), Russia (+0.7 million tons) and

Oman (+1.01 million tons) shipped more L.N.G. to Japan. At the same time,

Japan received less L.N.G. from Indonesia (-2.51 million tons) and Alaska

(-0.21 million tons). Among the other producers (those not bound through a

long-term agreement), it's important to consider Nigeria (+1.03 million tons).

According to Japan's Ministry of Finance, in October 2011

the country overall imported 6.12 million tons of L.N.G. with a 17.9 percent

increase in comparison to October 2010 (the highest annual increase since

August 2011, when Japan imported a record 7.55 million tons meaning a 18.2

percent increase than the August 2010 imports). Considering these data, it's

highly probable that adding all the involved exporters, Japan's L.N.G. imports

for 2011 will reach the amount of 78 million tons to 80 million tons from 70

million tons in 2010 (with at least a 10 percent increase).

These Japanese purchases will not be without consequences in

Asia. In fact, already few days ago, Nanang Untung, senior vice president of

Indonesia's Gas PT Pertamina (Persero) stated that Qatar seems currently less

attracted by the idea of exporting its L.N.G. to Indonesia than by the idea of

exporting to Japan. This could very soon be a problem for Indonesia, which has

recently encouraged the procurement of floating storage regasification units

(F.S.R.U.s). These units are the three F.S.R.U.s located in Belawan, Teluk

Jakarta and East Java (each has a capacity of 3 million tons per year). It's

quite evident that at least the F.S.R.U. in East Java could experience a

shortage of L.N.G. supply (up to now it has not secured any L.N.G. supply). All

this situation derives from the fact that Japan — given the strategic

importance for its economy of L.N.G. — is capable of purchasing L.N.G. at the

price of $14 per million British thermal unit (MMBtu), while Indonesia may

arrived at $11 per MMBtu (Japanese price is 27.2 percent higher than the

Indonesian price). Obviously, high prices will soon put some stress on the

business results of the Japanese power producers, but viable alternatives do

not abound. And rates for the December 2011 L.N.G. delivery is from $17 per

MMBtu to $17.50 MMBtu.

With no doubt, Qatar with its production capacity of 77

million tons of L.N.G. per year (by far the largest L.N.G. exporter in the

world) could profit from the upsurge of L.N.G. prices in the short-to

medium-term in the Asia-Pacific Region. In 2012, Japan and South Korea will

necessitate probably 25 million metric tons, which could rise to 49 million

tons in 2015 according to report released in December 2011 by Credit Suisse, a

Swiss bank. Not to mention an increase in the Chinese and Indian L.N.G. needs.

And this gas will come from Qatar. In fact, in the near term, the only player

capable of increasing its exports catching the L.N.G. demand without a

long-term contract is Qatar. Geographically speaking, Australia could supply

the Asia-Pacific Region, but its new liquefaction plants (among them Gorgon and

Queensland Curtis) won't be ready before 2014 with no significant contribution

to global L.N.G. production before 2015. Russia, already an L.N.G. seller to

Japan, would be an obvious candidate to supply additional tons of gas. In fact,

for Russia it's preferable selling gas to Japan and South Korea than to China.

Apart from Russia's gas projects in the Pacific also the Yamal L.N.G. project,

located in the Yamal Peninsula (facing the Arctic Ocean), is developed

targeting Asian buyers and one of them could certainly be Japan. And in order

to partially lower L.N.G. prices it could also be of huge utility for Japan to

have different sellers like Qatar, Australia and Russia. The problem is that

apart from Sakhalin-2, which already well serves Japan, the other Russian

L.N.G. projects will take time before being operative.

In other words, up to 2015 the real player with monopoly

power in relations to short-term supply to be delivered to Asia — and

consequently to Japan — will be Qatar. Now, the real job for the Gulf country

will be to convert short-term supply into long-term supply based onto long-term

contracts. The 2.77 million tons increase in L.N.G. sold to Japan from April to

October were mainly diverted cargoes, which initially were supposed to ship

L.N.G. volumes to Europe. At this regard, in September 2011, Qatar publicized

plans of doubling its long-term contracts to Asian countries in the next years

up to 20 million metric tons annually. In the end, at least for the next three

years, Qatar has now metaphorically and concretely the power of moving the

rudder.